Budgeting and forecasting software for small businesses

Don’t let your small business flounder in uncertainty. With our small business forecasting software, you can easily model future profitability and steer your business in the best possible direction.

By analyzing different potential scenarios, you will create a dynamic business plan that you can adjust as conditions change. We help you create financial forecasts that are easy, understandable, and actionable.

Adaptive planning to keep you on track

By harnessing the power of dynamic planning, you will free yourself from guessing and from being locked into static business plans that don’t work.

Go from stressful spreadsheets to successful planning

Excel spreadsheets are too complex for the average small business owner. We let you easily build financial forecasts to make calculated and informed business decisions.

How Profit Frog helps business owners

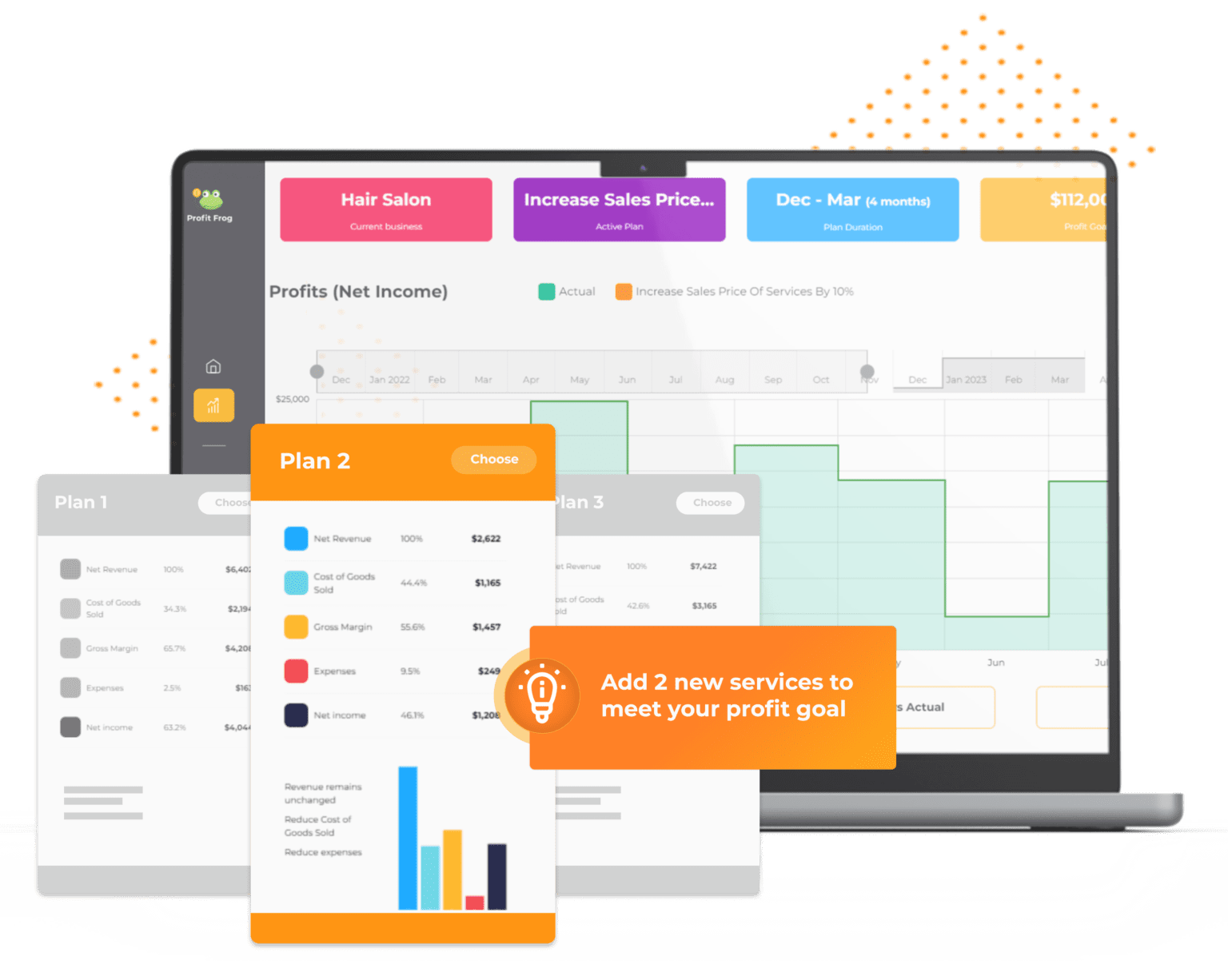

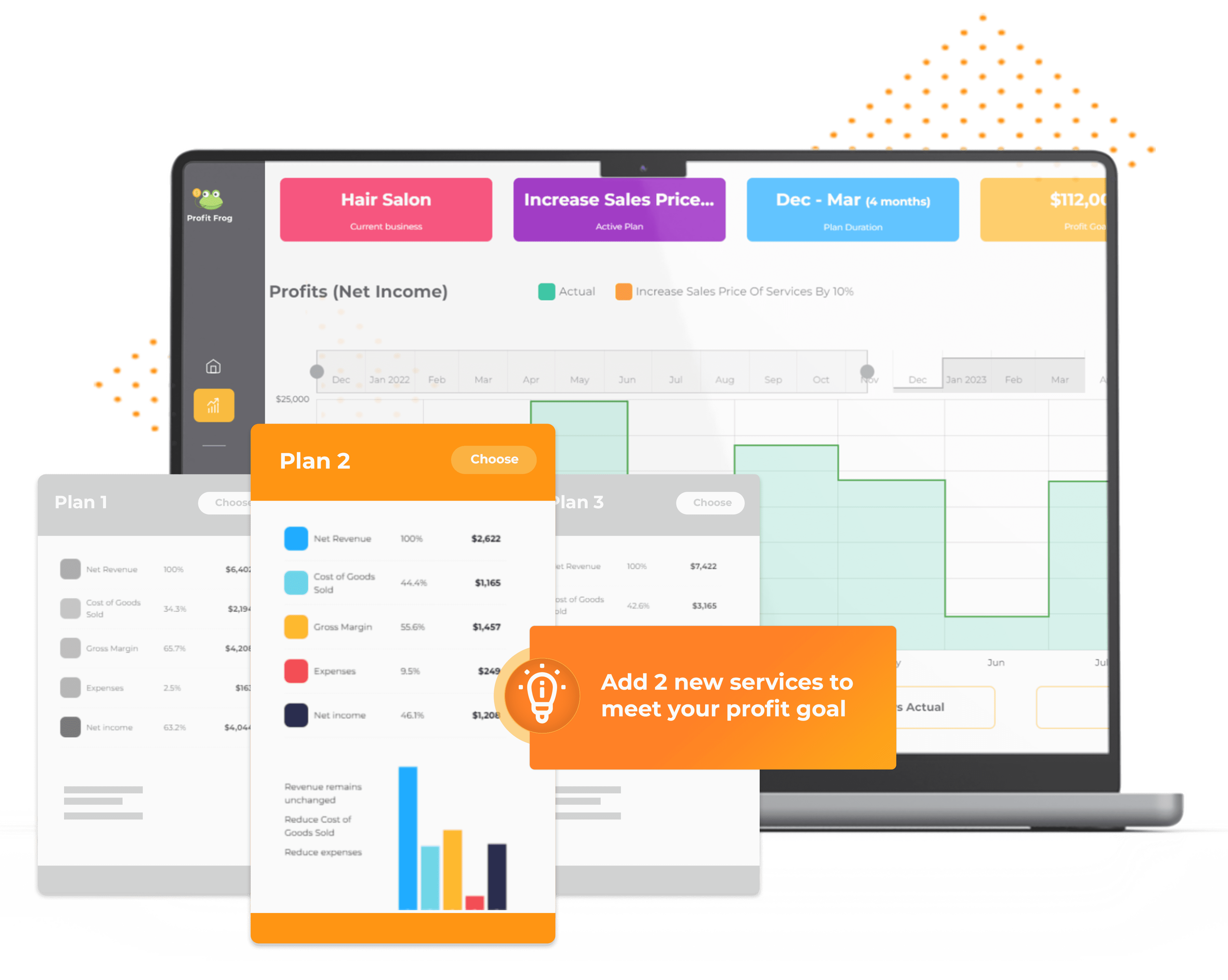

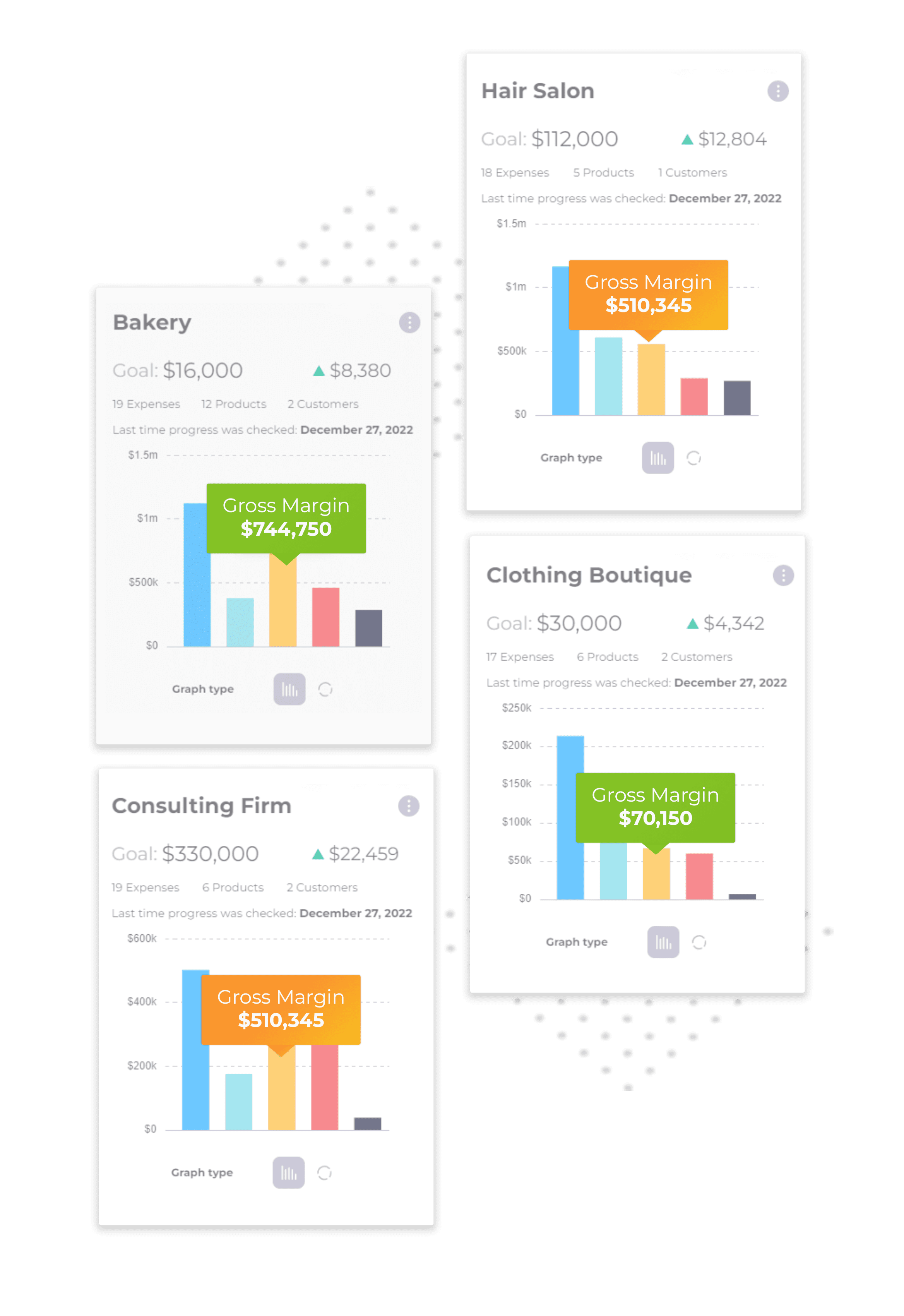

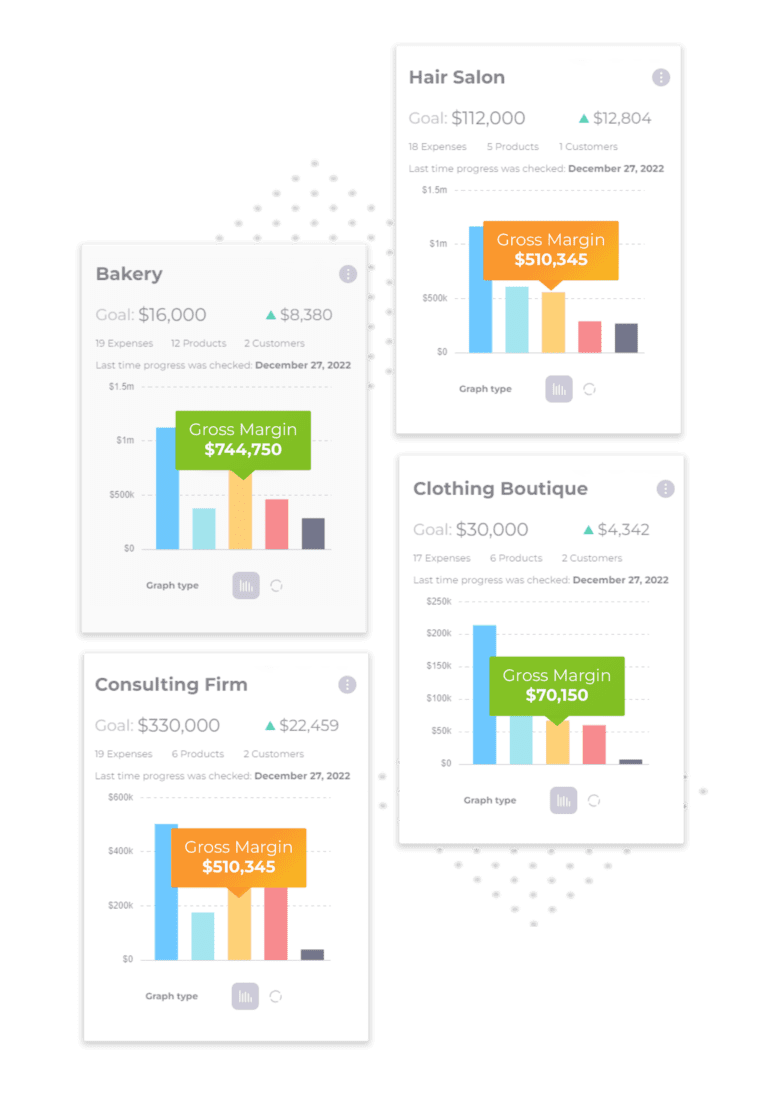

You shouldn’t need an MBA to get a handle on your profitability. Profit Frog gives you a clear, precise view of what’s happening with your business based on real-time information. Unlike other budgeting and forecasting tools, our planning software strips away the clutter and focuses on thing that matters: profits.

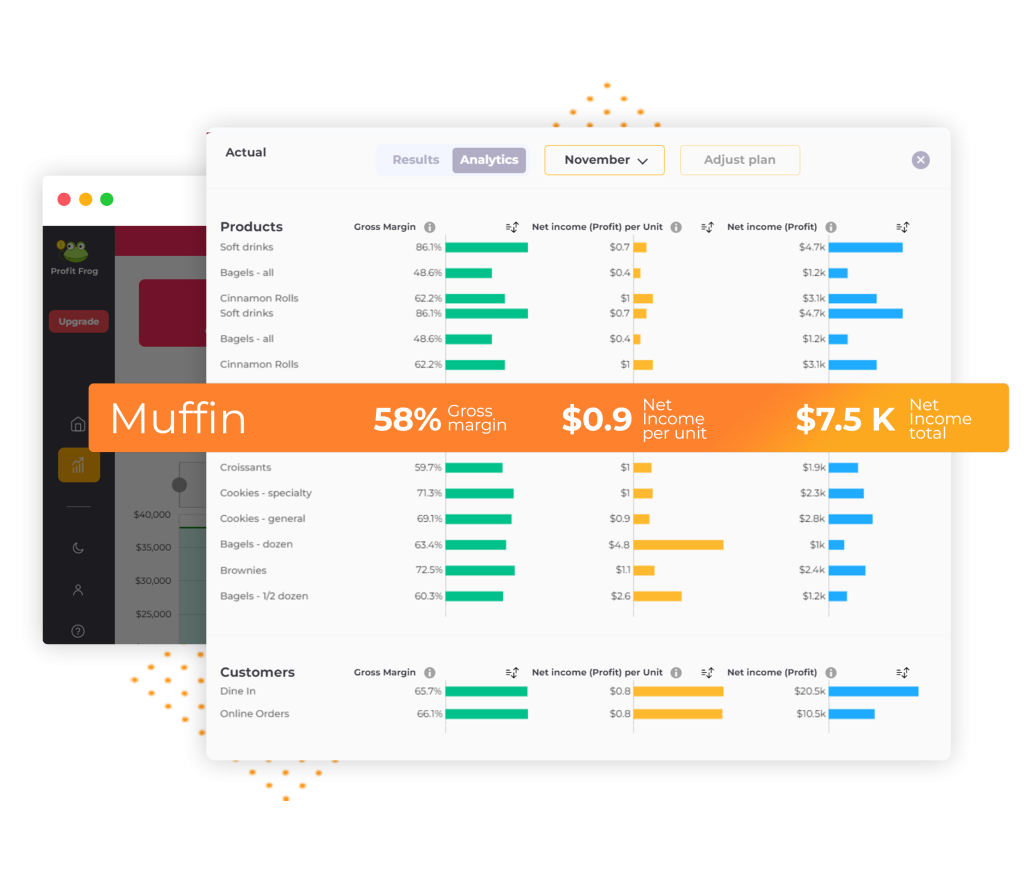

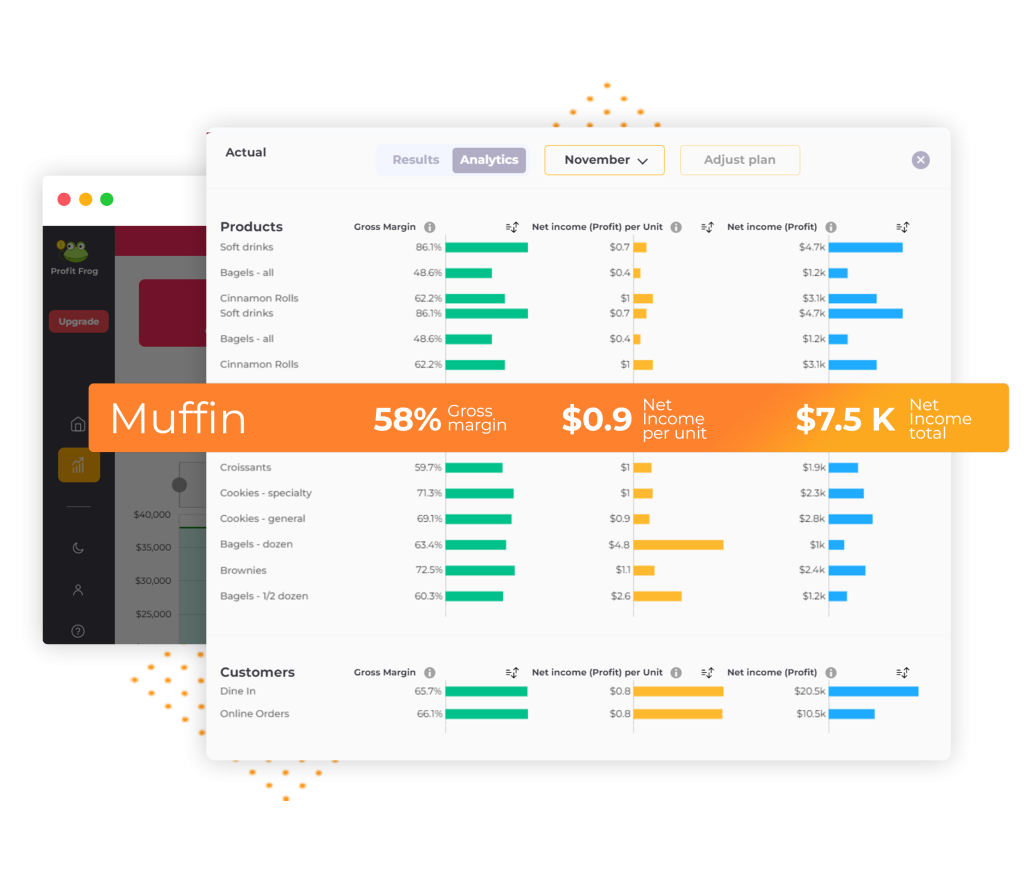

Profit management made easy

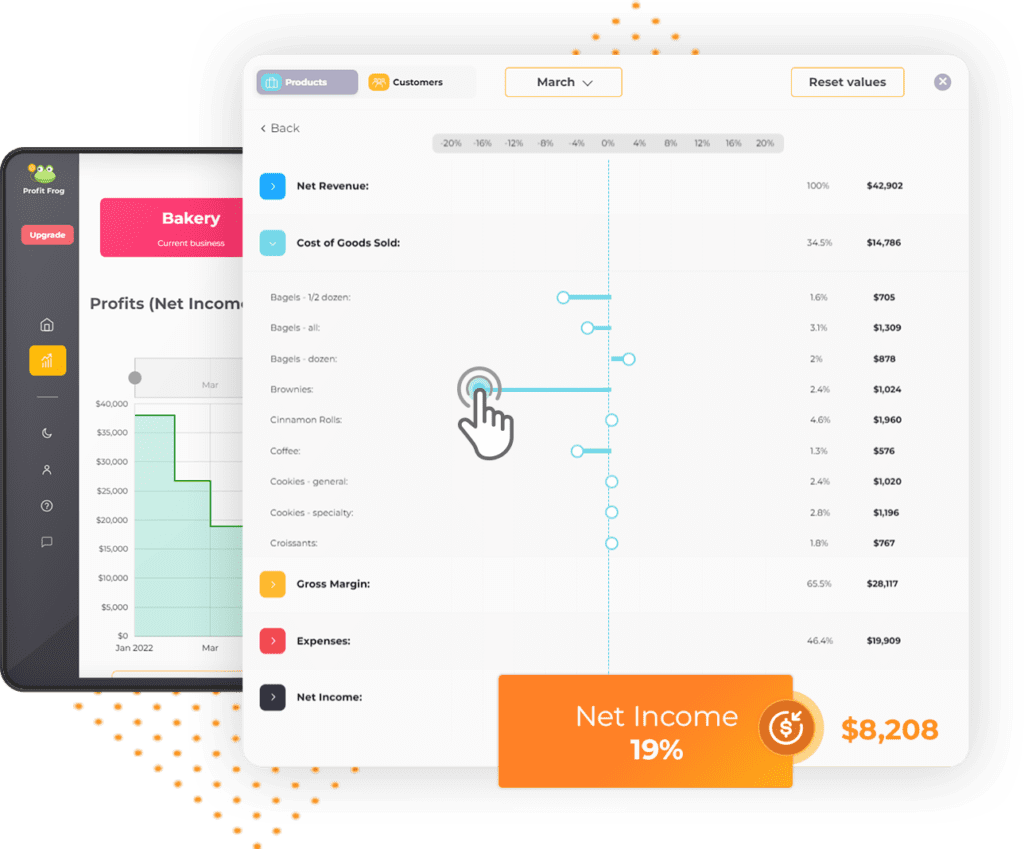

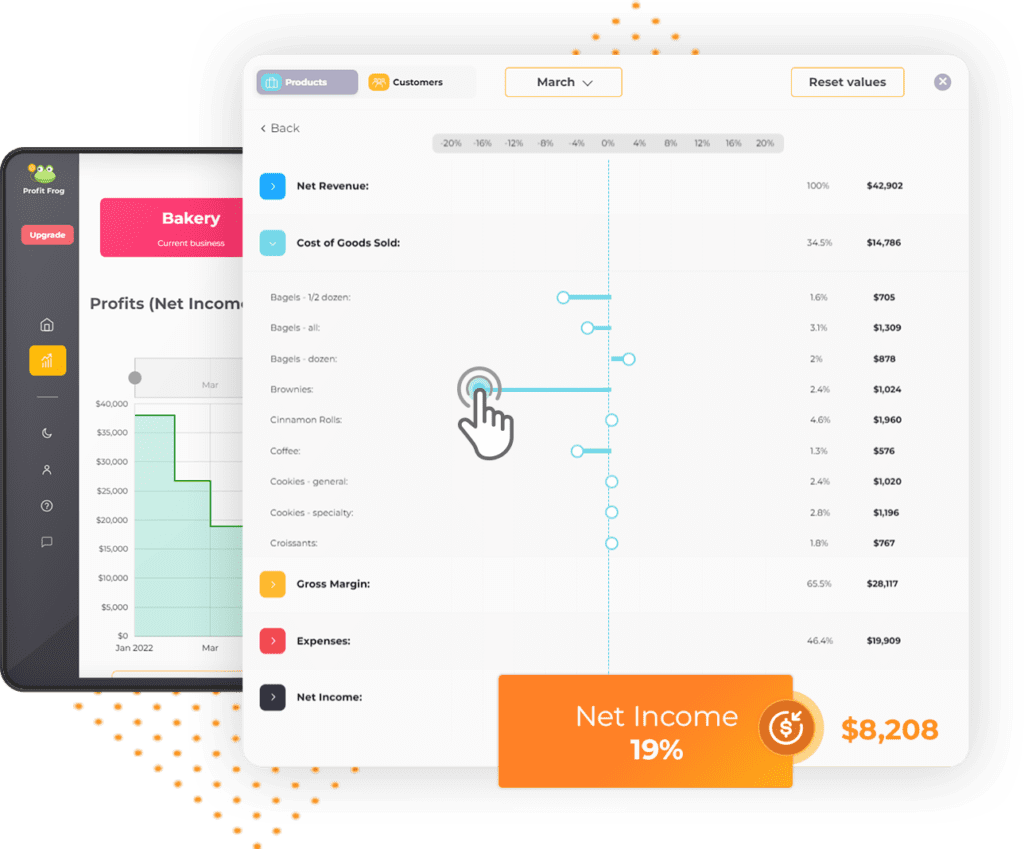

Profit Frog gives you a clear, precise view of what’s happening with your business based on real-time information. It then allows you to project that clarity into the future with profit forecasting according to different variables you can adjust dynamically.

Profit management made easy

Profit Frog gives you a clear, precise view of what’s happening with your business based on real-time information. It then allows you to project that clarity into the future with profit forecasting according to different variables you can adjust dynamically.

Targeted resource allocation

Having a fundamental understanding of what drives your profits allows you to know where to allocate resources in the future.

Targeted resource allocation

Having a fundamental understanding of what drives your profits allows you to know where to allocate resources in the future.

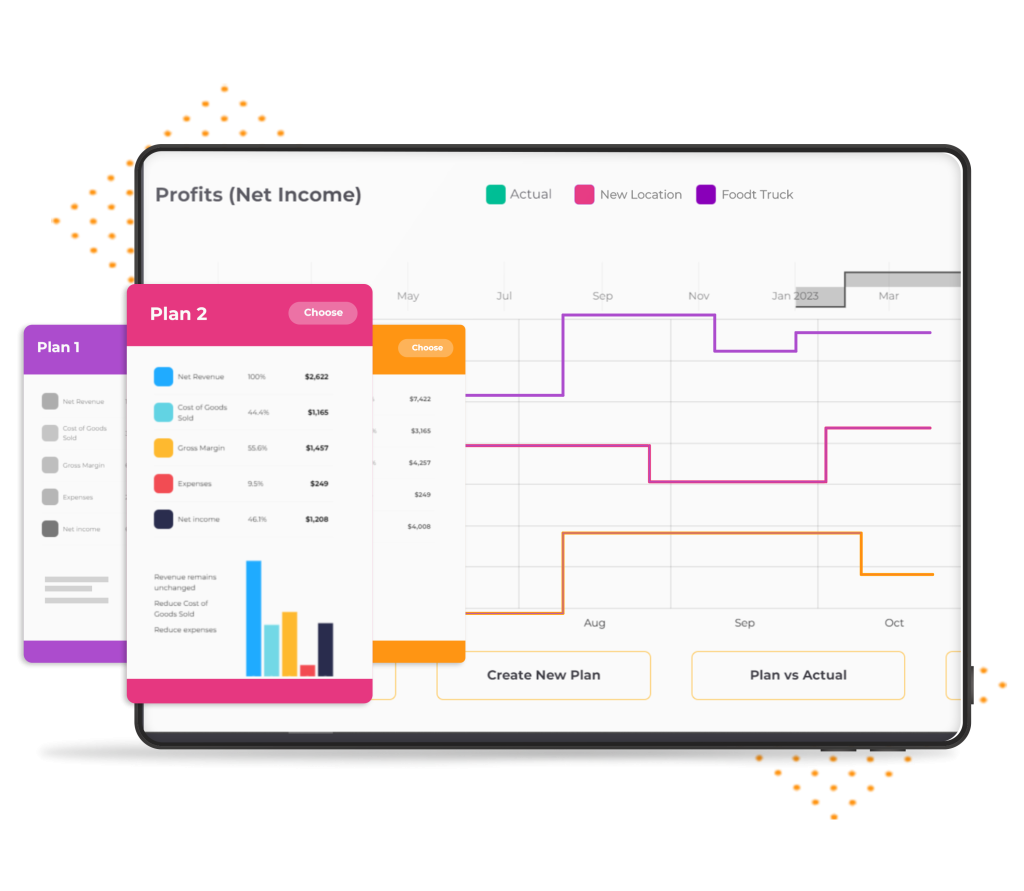

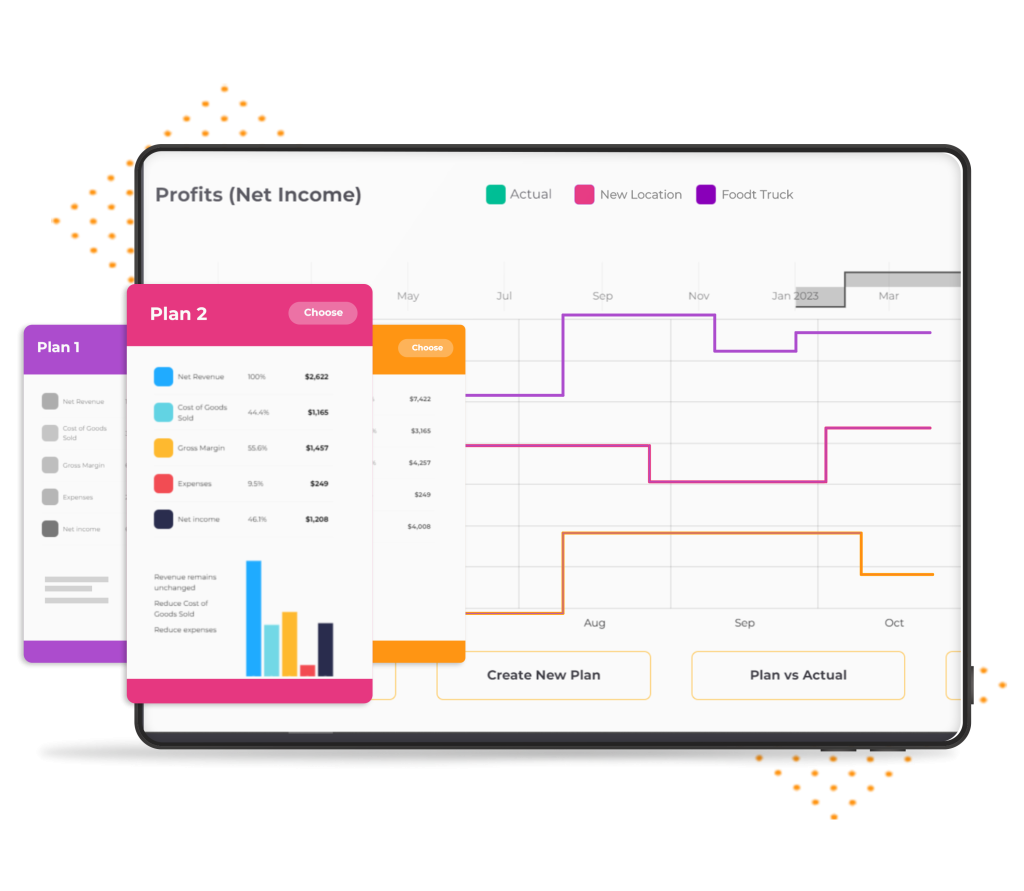

Dynamic scenario planning

Having a fundamental understanding of what drives your profits allows you to know where to allocate resources in the future.

Dynamic scenario planning

Having a fundamental understanding of what drives your profits allows you to know where to allocate resources in the future.

Start your free trial today

Get a better understanding of your profitability. Start your free 14-day trial of Profit Frog, no credit card required.

Get a better understanding of your profitability.

Start your free 14-day trial of Profit Frog, no credit card required.

Import data from Quickbooks or Excel

Profit Frog FAQ

Welcome to our FAQ section! Here you’ll find answers to some of the most common questions about our products and services. If you don’t find what you’re looking for, please feel free to contact us.

Does Profit Frog integrate with Quickbooks?

Yes, Profit Frog integrates with QuickBooks Online (QBO). Easily import your data from QBO and you’ll soon be planning, budgeting, and forecasting in Profit Frog. You’ll be able to generate dynamic forecasts of future financial performance and profitability under different scenarios.

Does Profit Frog replace Quickbooks?

No Profit Frog does not replace QuickBooks or your current accounting solution. Think of us as a financial planning add-on that gives you insights and reporting capabilities that online accounting software does not provide.

Essentially, our financial performance management software extends the capabilities of your current online accounting solution.

Can I change or cancel my Profit Frog plan anytime?

Yes, Profit Frog has no long-term contracts and will allow you to change or cancel your plan at any time.

How does Profit Frog onboarding work?

Profit Frog is so easy that you can get set up all by yourself. That said, we do offer a free, one-on-one white glove onboarding service when you sign up for the free trial.

What is the best budgeting and forecasting software for small businesses?

Profit Frog is the best forecasting software for small businesses because we eliminate clutter and focus on the metrics that matter most to a small business owner. Specifically, we model profitability under different dynamic conditions.

Profit Frog takes all your actuals and uses them to forecast multiple possible futures that you can manipulate. We call these “profitability models” and they allow you to create a dynamic plan that can be adjusted as conditions change.

From accounts payable to cost of goods sold to operating expenses and other financial statements, we factor all your key business drivers and allow you to manipulate them to envision future scenarios. It’s the ultimate performance management tool.

What is financial forecasting software?

Financial forecasting software helps companies visualize the future under different types of conditions. Depending on the forecasting software, companies can model cashflow, costs, and other key metrics based on their financial data and business goals.

Profit Frog allows business owners to model profitability under dynamic conditions. We focus on profitability because profits are what matter to small business owners.

Does QuickBooks do forecasting?

If you’re a QuickBooks Premier, Accountant, or Enterprise user, you do have access to some forecasting capabilities. Specifically, an accounting tool such as QuickBooks Online Advanced can help you forecast revenue based on expense tracking and previous performance.

Firstly, business accounting software forecasting is based on past performance. What if you want to forecast based on other variables that have nothing to do with the past? Profit Frog allows you to do just that.

Secondly, QuickBooks forecasts revenue. While revenue is important, profit is more important. Our profit forecasting includes revenue as per the classic business profit formula: profit equals revenue minus expenses. By forecasting profit (revenue and expenses) instead of revenue only, Profit Frog allows for more accurate and actionable financial modeling.

After all, would you want higher revenue if it meant lower profits? No. Neither would we. Yet such a scenario does happen in business if expenses increase in greater proportion than revenue.

Forecasts from QuickBooks and other expense tracking software are limited in nature because they are based strictly on projecting into the future from current and past financial reports. Profit Frog, in contrast, allows you to manipulate different variables to see into the future.

For example, you can increase or decrease COGS, change the unit price of your product, increase your salesforce, or otherwise instigate hypothetical variations from your actuals. These hypotheticals are called scenarios, and the discipline of forecasting into an uncertain environment is called scenario planning. Scenario planning helps your business be antifragile.

Is Profit Frog a business budget software?

Profit Frog includes budget processes, along with so much more. Our software solution focuses on helping you maximize profitability by being aware of all the key factors of your business. From COGS to sales to overhead, you will have an extremely accurate view of present inflows and expenses, and will be able to forecast future profitability. In that sense, we do function as a budget software, because we help you with expense management and visibility. But we go way beyond budget planning.

Where other budgeting tools are static, our budget and forecast processes deliver a dynamic plan that you can consistently update as actual conditions change.

How do you forecast a P&L?

You forecast profit and loss by forecasting total sales, forecasting expenses, and subtracting the latter from the former. Profit Frog does this easily for small business owners, and allows them to manipulate different key variables to see how future profits change under different conditions.

With Profit Frog, you don’t need entire finance teams and budget maestros on staff. You just need to follow our easy step-by-step process to generate your own profit forecasts.

How do you forecast profit margin?

A rolling 12-month projection is one of many forecasting methods that looks 12 months into the future. Unlike a calendar year forecast, the 12-month rolling forecast continually adds an additional month to the forecast each time a month ends. Thus, the 12-month projection helps you plan and forecast for the next consecutive 12 months into the future.

- forecast profits (revenue minus expenses)

- divide gross revenue by profits

- multiply the number from Step 2 by 100

Our profitability management software does the heavy lifting. Not only do we help you forecast your profit margin, but we do so under multiple potential scenarios in a way that can be dynamically altered and updated.

Read our article on profit vs revenue to see why we make profitability our focus.

How do you forecast profit in Excel?

Excel forecasting is typically done by specialists in large corporations that have the budget to hire said specialists. We created Profit Frog to spare you (and ourselves) the headache of forecasting in Excel.

If you must know, however, the basics of how to create a Microsoft Excel forecast can be found in this article.

Is Profit Frog a demand forecasting software?

We are not exactly a demand forecasting solution; we are something even better. You can use Profit Frog to model profitability by adjusting expected demand, expenses, sales volume, and much more. This is known as adaptive planning, dynamic planning, or scenario planning—and it is the next step beyond demand forecasting.

Is Profit Frog a business management software?

We are not a complete project management or business management platform, which most small and medium sized businesses don’t need anyway. Rather, we are a financial management software focused on profit optimization. From your supply chain through your sales cycle, we help you track expenses and model which business decisions will bring greater profits.

Essentially, we help you find the path of least resistance to make and keep more money. This helps you save time, have less stress, and be more productive. These are the end goals of every corporate performance management software program, anyway, right?

Start your free trial today

Get a better understanding of your profitability. Start your free 14-day trial of Profit Frog, no credit card required.

Get a better understanding of your profitability.

Start your free 14-day trial of Profit Frog, no credit card required.