Profitability modeling software for small businesses

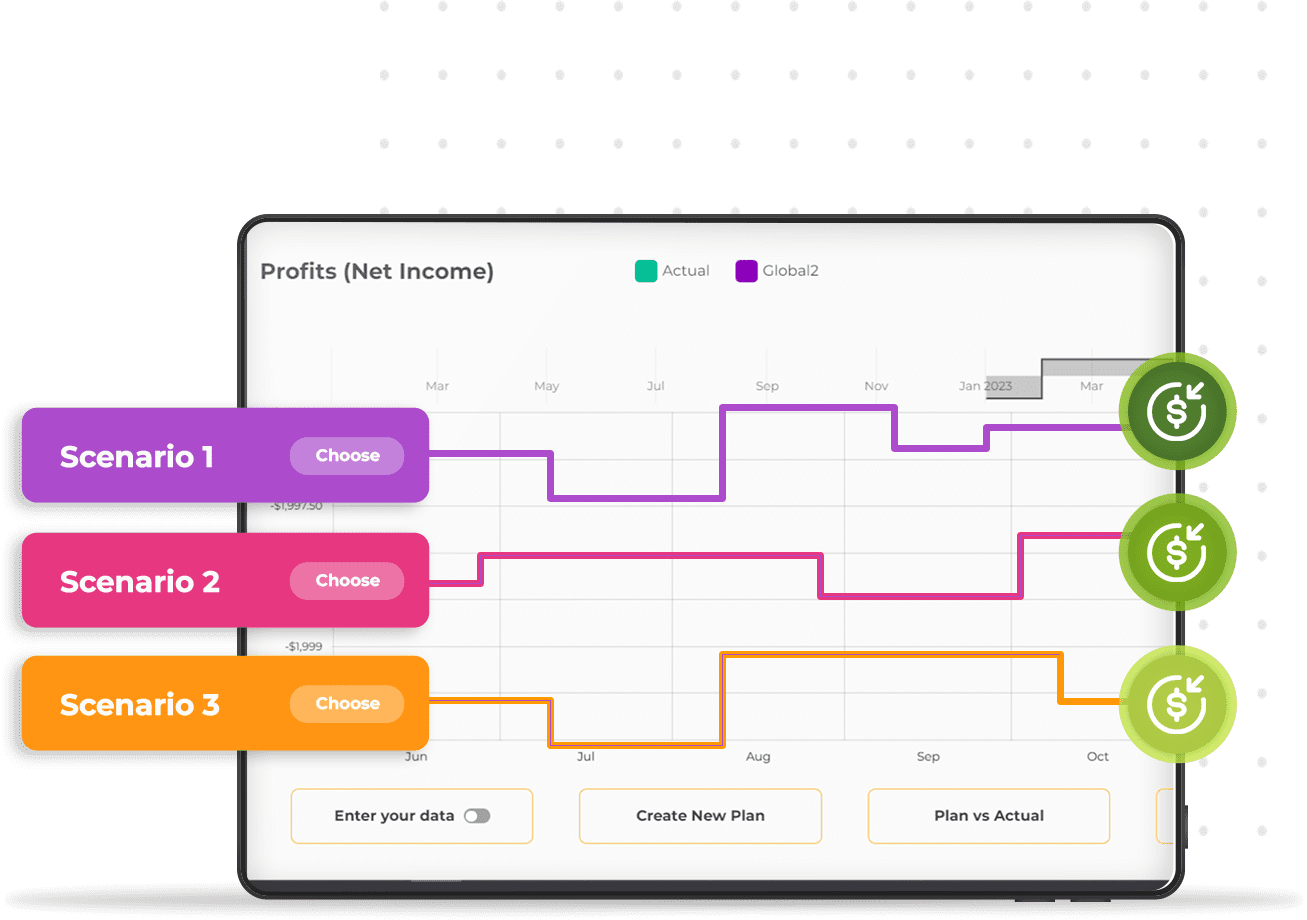

With the superpowers of profitability modeling and scenario planning, you can get rid of uncertainty and take charge of your company’s financial future.

Dynamically adjust fixed and variable costs, per customer profitability, gross revenue, and other economic inputs.

Watch your profit margin change before your eyes in response.

Get visibility into which business levers you can pull to maximize profit.

Gain new insight into which costs and liabilities are dragging your business performance down.

Forecast profitability.

Reduce fear and uncertainty.

Owners of small businesses deal with crushing uncertainty about the future. With dozens or hundreds of variables—most outside your control—it’s hard to feel confident in your business plan. Profit modeling is the answer. You can easily see the things you can change and how you can steer your business to make more money.

Our software gives you a clear view of present and future profitability and allows you to model different what-if scenarios.

Profit model example: how Profit Frog can help

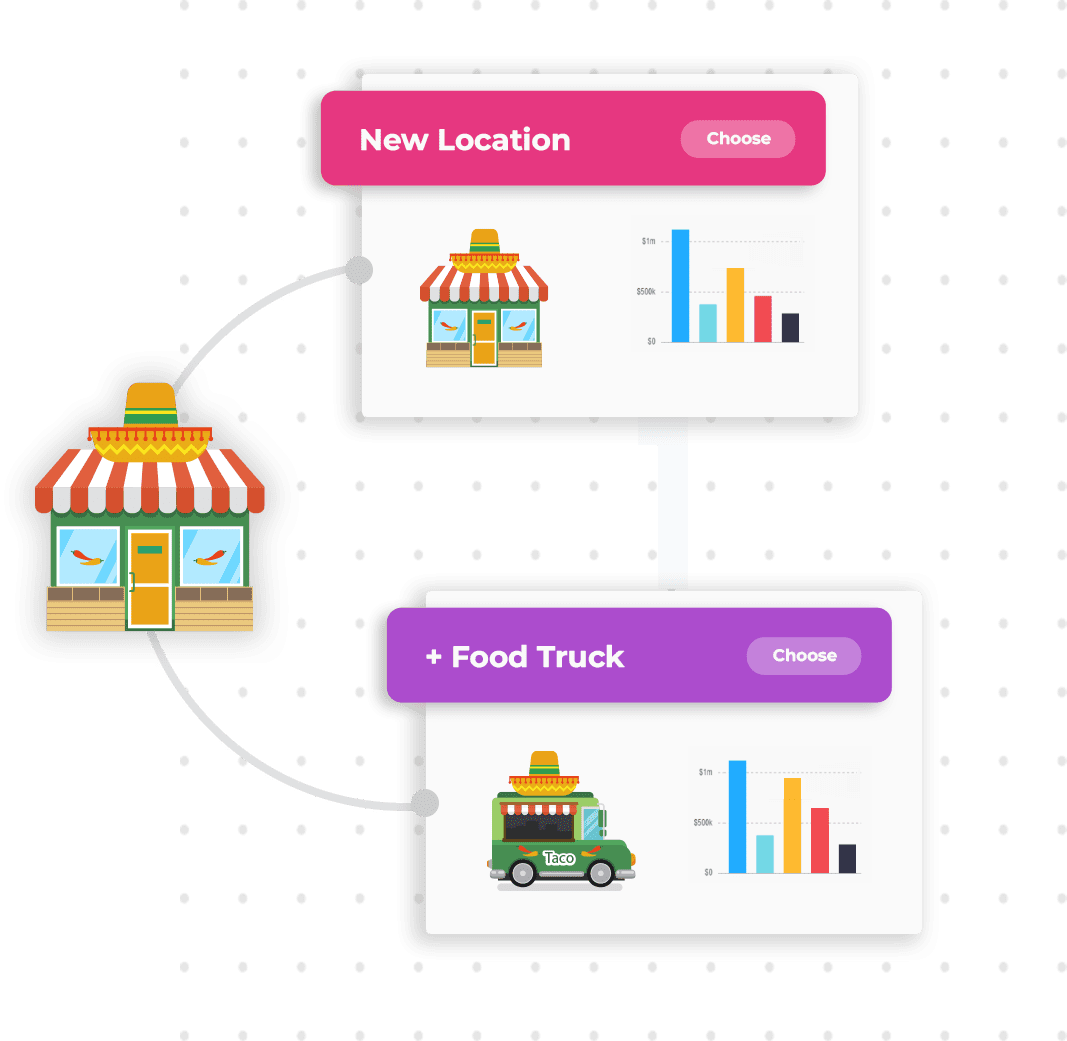

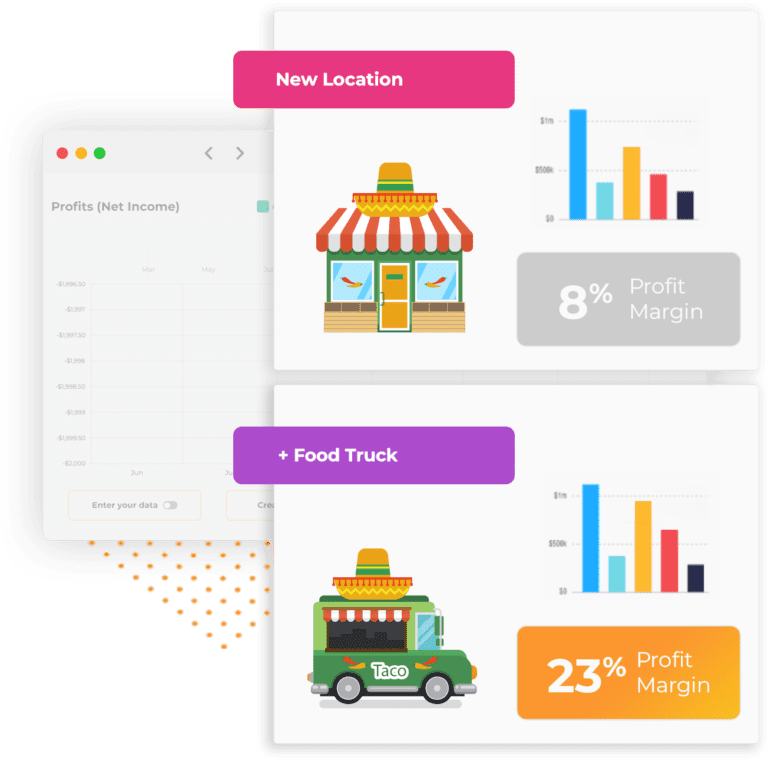

A restaurant chain called Taco Fiesta wants to grow after seeing its biggest jump in sales since COVID. All three locations are operating at maximum capacity during prime lunch and dinner hours.

Taco Fiesta is considering opening another restaurant in a neighboring city. One of the owners has the idea to invest in a couple of food trucks instead.

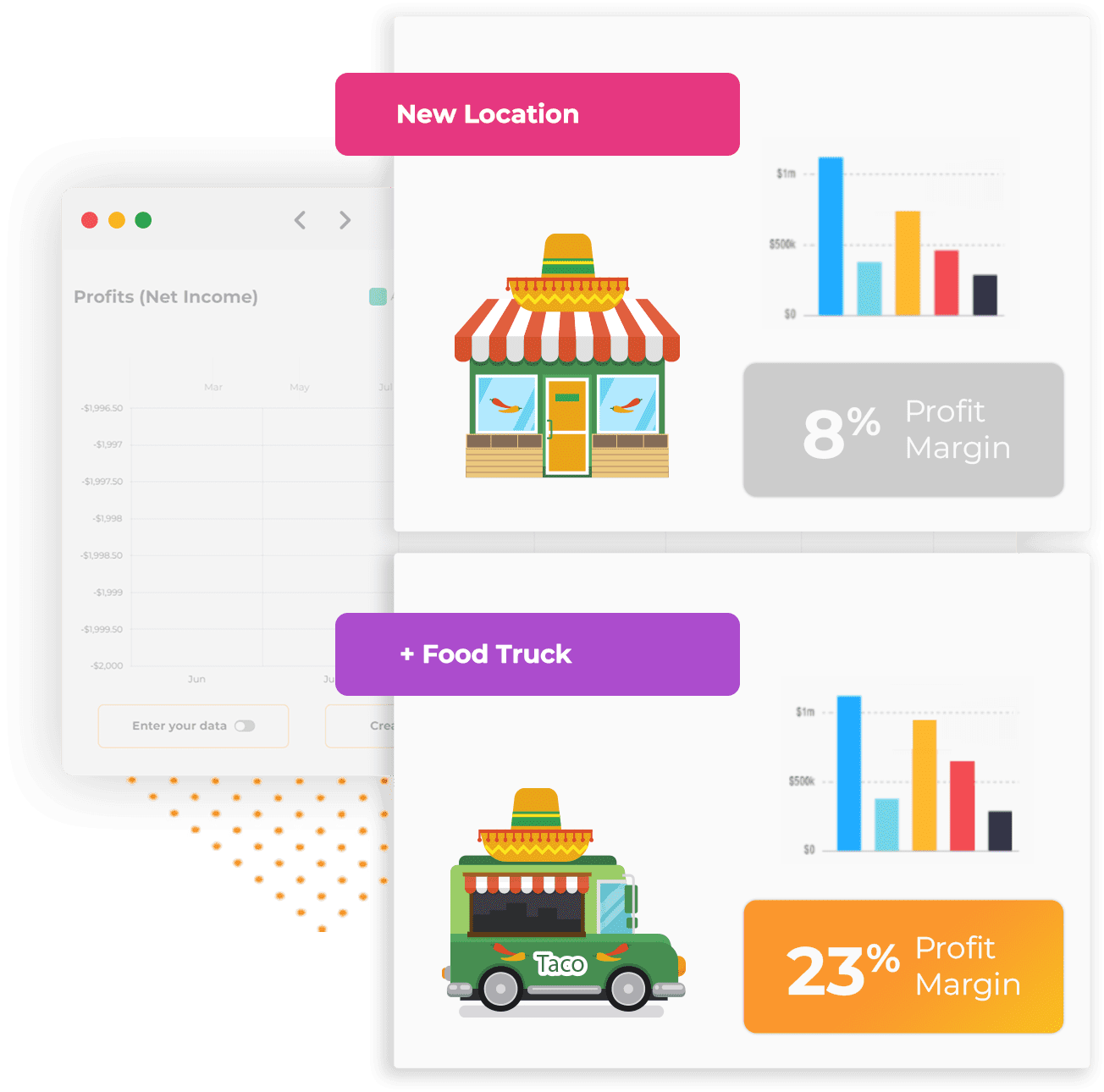

From 8% to 23% pm

Luckily, Taco Fiesta uses Profit Frog and does profit modeling for both of these situations.

- Open a new restaurant location

- Deploy one or more food trucks

After modeling both scenarios through Profit Frog, they see that their profit margin per restaurant is 8%, while a food truck will have a 23% profit margin.

Taco Fiesta decides to buy one food truck right away and then two more over the next few months. They hold off on opening any new restaurants.

Small businesses that choose Profit Frog

Start your free trial today

Get a better understanding of your profitability. Start your free 14-day trial of Profit Frog, no credit card required.

Get a better understanding of your profitability.

Start your free 14-day trial of Profit Frog, no credit card required.

Why use profitability models for forecasting?

Most financial analysis software focuses on modeling revenue or cashflow. We focus on profit. Profit models are superior to revenue models.

Profit modeling is better than revenue modeling

Cash flow, or gross revenue, is only part of the picture. Expenses—fixed and variable costs—make up the other component. Financial modeling of revenue, used in isolation, can lead you astray.

Profit modeling includes revenue modeling. That’s because profit equals revenue minus expenses. So, to model profitability, we are also modeling revenue and expenses. You’re getting a clearer picture of what’s really going on in your business.

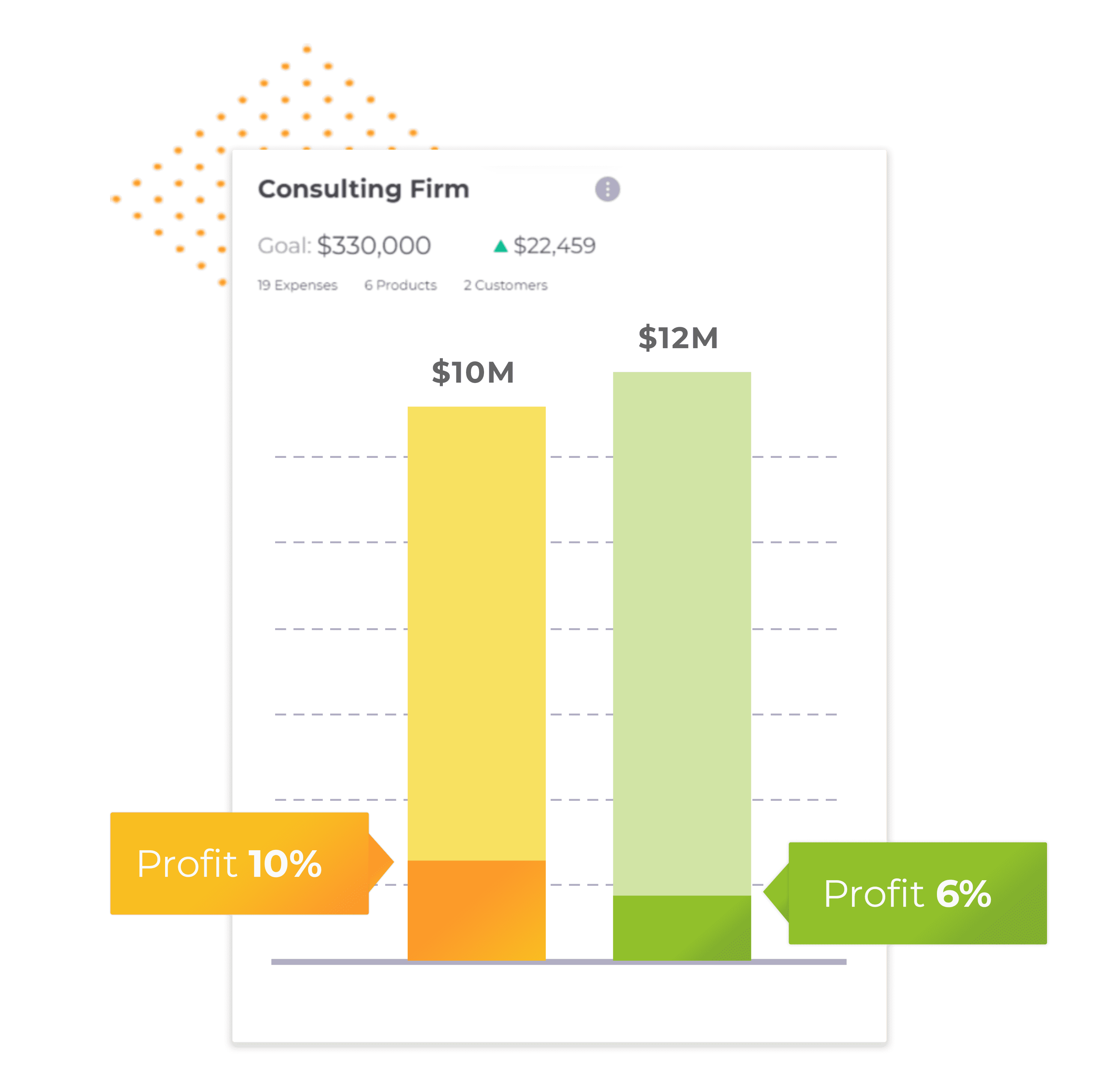

You care about profit more than revenue

Imagine you own a business doing $10 million per year with a 10% profit margin. You make a million dollars per year in profit.

Imagine an opportunity to increase revenue to $12 million per year. Sounds pretty good, right?

Not so fast.

What if that extra $2 million per year in revenue dropped your overall profit margin to 6%? Now you’re working harder for less money. Your annual profits just shrank by $280,000 to $720,000 per year.

By modeling profit instead of revenue only, you can maximize the only thing you really care about in the end: the excess money that the business generates after expenses.

What Profit Frog customers are saying

“Profit Frog has completely transformed the way I run my small business. Their accounting system is user-friendly, efficient, and has helped me stay on top of my finances. I highly recommend it to any small business owner.”

Santiago

SSCHAMBERGER

As a small business owner, keeping track of finances can be overwhelming. Profit Frog has made it easy for me to stay organized and on top of my accounting. The system is intuitive and has saved me a lot of time and stress.

Dario G.

Entrepreneur

I’ve been using Profit Frog’s accounting system for several months now and it has been a lifesaver. The reports and insights it provides have helped me make better financial decisions for my business and I couldn’t be happier with the results.

Donna

Small Business Owner

What is profitability analysis software?

Profitability management software is an analysis tool that can help you find out more about how your business makes money—and how you can make even more money while keeping costs down. It lets you look at profitability from different angles so that you can conduct effective enterprise resource planning.

Before Profit Frog came along, profitability analysis software was made for big companies. This left small business owners in the dark. In contrast, Profit Frog will help you gain profitability insights quickly and easily

With Profit Frog, you decide which factors you care about analyzing. These can be market trends, current shifts, or potential scenarios that might unfold in the future. Then, in a process called “scenario planning,” you try to predict how different hypotheticals will affect your profit.

What do we use profitability analysis software for?

Here is how profitability analysis software can aid your small business.

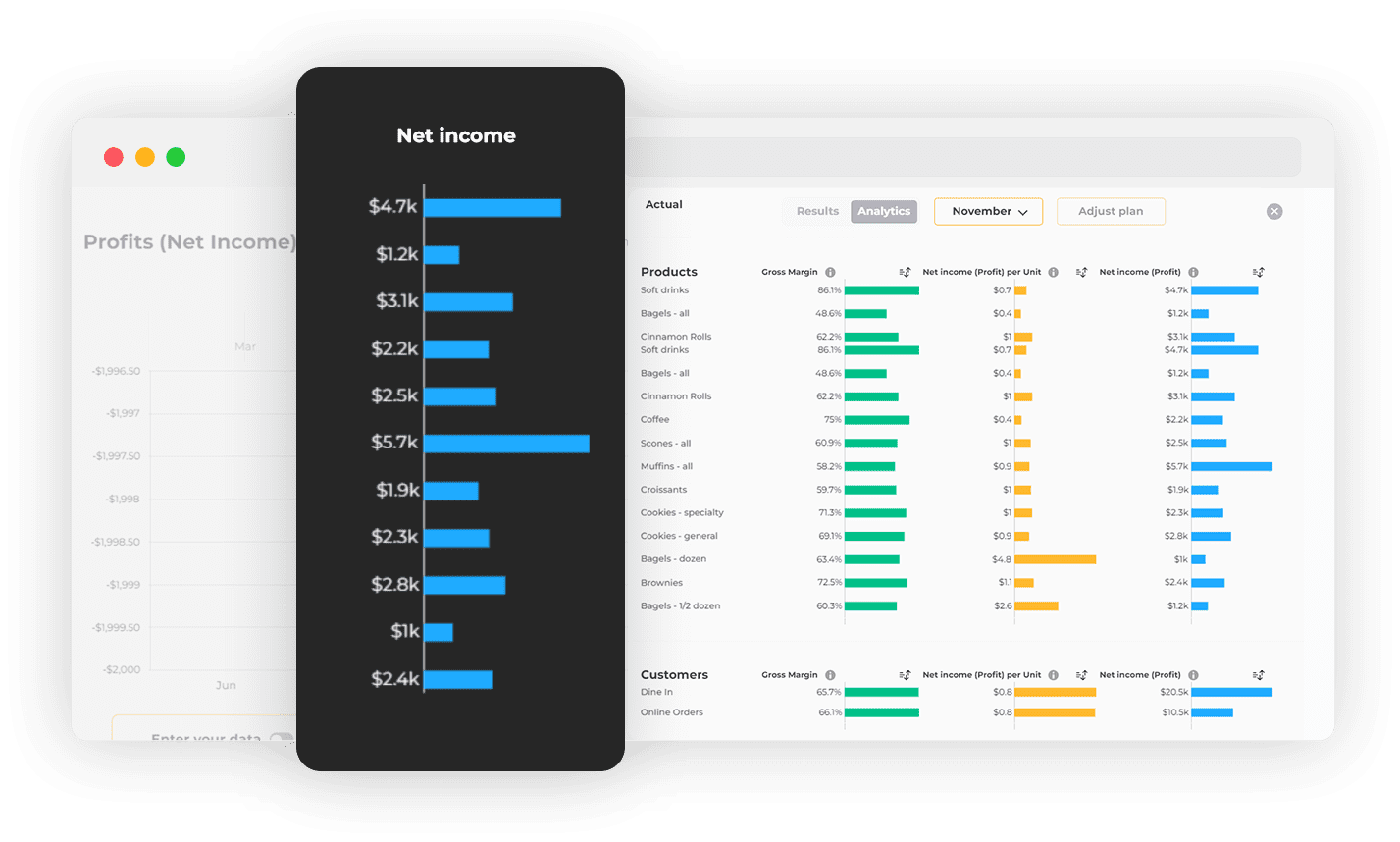

Identifying optimal product mixes

Profitability analysis software can show you which product combinations will generate the most profit.

Keeping track of performance

Analyzing profitability helps track your company’s performance. Tracking performance is useful when doing advanced analytics, planning, budgeting, and forecasting for the future.

Understand return on equity

Return on equity is a financial metric that tells you how well your company is making money off of its own investments.

Examine customer and vendor relationships

Profit analysis is done by business owners because it helps them figure out what financial data they need to pay attention to make sure their business is financially healthy.

Profit Frog FAQ

Welcome to our FAQ section! Here you’ll find answers to some of the most common questions about our products and services. If you don’t find what you’re looking for, please feel free to contact us.

What is the best financial profitability model?

The best financial profitability model is the one that puts you in the driver’s seat of your business. As a small business owner, you don’t need a complicated analytic model created for Fortune 100 companies. And you definitely don’t have time to be buried in Excel spreadsheets. You need a simple, actionable snapshot of your business drivers and how changes to them can affect business profitability. From asset turnover to the impact of various product offerings to the cost of labor, Profit Frog gives you full visibility of what matters so you can forge your own destiny.

What is the profit model formula?

The simplest profit model formula is that profit equals net revenue minus Cost of Goods Sold minus expenses. It doesn’t need to get more complex than that. Some forecasting methods overcomplicate things. We don’t. Our profitability analysis software has everything a small business needs; nothing it doesn’t.

What KPI is most important for measuring profitability?

Net profit is the most important KPI for measuring profitability. Some types of profit models focus on gross profit, which is not true profit. We focus on net profit, which is true profit.

Gross profit is total revenue minus direct expenses. It does not factor overhead, taxes, or other “indirect” expenses.

Net profit is actual profit. It’s gross profit, minus ALL other expenses. It’s the number that you as a business owner really care about. And it’s the number we help you maximize.

To create a profit model for your small business,

To create a profit model for your small business, log in to your ProfitFrog account and enter your business variables. It’s so easy. Our forecasting software will generate a profit model, and you can dynamically interact with it by changing various inputs and watching how they affect profitability. It’s magic for your business.

What is profitability projection?

A profitability projection, also termed a profit and loss forecast (or P&L forecast for short), is a prediction or projection of how much money your business will make based on specific conditions you define. For example, you can forecast how much your profit will be if you release a new product or service, if you alter pricing, if costs increase or decrease, or for any number of other variables. Profit forecasting is crucial for navigating changing market conditions and unknowns.

Profit Frog allows small businesses to do this type of P&L forecasting easily and without needing to wade through complicated analytical models.

How do you improve profitability?

Improving profitability in your small business comes down to three factors:

- Increasing revenue

- Decreasing cost of goods sold (COGS)

- Decreasing expenses

Profit Frog gives full visibility into all three aspects, and allows you to dynamically model how profits will be influenced by various potential future influences and fluctuations.

What are the three main profitability ratios?

The three most common types of profit ratios are net profit margin, operating profit margin, and EBITDA margin.

- Net profit margin: the metric that small business owners care about most. Profit Frog focuses on this one. Net profit is simply income minus expenses. All business expenses are factored in. Net profit is the best measurement of how your business is doing.

- Operating profit margin is factored by subtracting operating expenses from revenue. Operating expenses are defined as those expenses that are incurred as costs of running the business day to day, or in other words, the costs of actually delivering your product or service to the customer. These are also sometimes called “cost of goods sold” and abbreviated COGS. The operating profit margin does not account for overhead, taxes, and other non-COGS expenses.

- EBITDA margin: similar to the operating profit margin, but neglects depreciation and amortization. The EBITDA calculation looks like this: (Net profit + Taxes + Interest + Depreciation + Amortization) / Revenue x 100.

Does all this sound a bit too complicated? Don’t worry: that’s why we created Profit Frog. You don’t really need to lose sleep over different profitability ratios; nor do you need to know how to perform a linear regression, build a complex historical model or hire a full time data analyst. We give you fast and easy insights into the profit drivers of your business so you can make the choices that matter for your future.

What is the best measure of profitability?

The best measure of profitability is how much money your business has remaining after it pays all expenses. This is money that you as the owner can draw—or you can choose to reinvest it into the business. It’s “extra” money, and it’s the entire reason you’re in business: to have more of it. Profit Frog helps you get more of it by modeling the drivers of profit under different conditions (“what if scenarios”), so you can make better choices and eliminate uncertainty.

How many types of profitability ratios are there?

Depending on who you ask, there are anywhere from three to five profitability ratios in business. Let the Wall Street analysts focus on these.

As a small business owner, you really need to model one: net profitability. Here at Profit Frog, our core value proposition is that we make profit modeling accessible to Main Street businesses by making it simple. Net profit is simply your total business revenue, minus total business expenses. We give you the tools to forecast and maximize what matters: net profit.

From the profit model we generate, you can play with different scenarios and forecast the effect on your bottom line if you (for example):

- Are more effective at generating sales

- Allocate costs more efficiently

- Get a better rate of return on your business’s surplus cash

- Have a lower asset turnover ratio (extend the life of your company assets)

- Give employees a raise

- Find a lower-priced vendor for important inputs to your business

We focus on the financial results that matter to you: money the business can put in your pocket.

Start your free trial today

Get a better understanding of your profitability. Start your free 14-day trial of Profit Frog, no credit card required.

Get a better understanding of your profitability.

Start your free 14-day trial of Profit Frog, no credit card required.